Balancing Competing Initiatives

By Bruce Fleming, EVP Strategy at Calumet Specialty Products and Member of the Board of M&A Standards

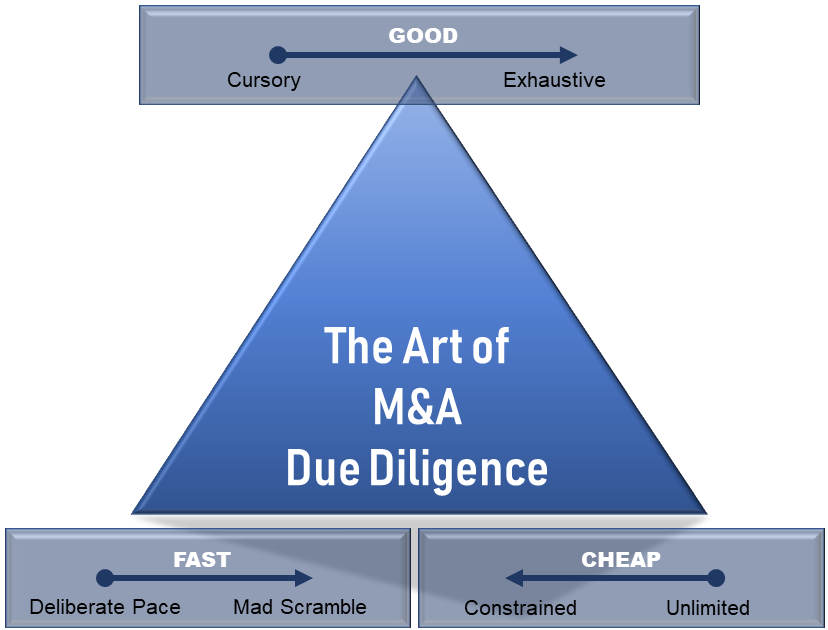

I’ve sometimes been asked what percentage of the deal price should be budgeted for diligence costs. Many deal costs do have a quick rule of thumb, but with respect to Due Diligence it’s safe to say “It depends.” Do you want the diligence to be good, fast, or cheap?

Good, Fast or Cheap? “Pick Two” of the Big Three.

I’ve seen diligence cost anywhere from 1% to 40% of enterprise value. (The high percentage was a very small transaction and included legal and integration pre-planning costs.) Why the range? Each of the “Big Three” drivers offers a spectrum of outcomes and tradeoffs. The art for each deal lies in finding the unique balance:

- Good? More diligence may reduce risk to Buyer, if it’s focused on the right issues, but more diligence means more cost. Decide if the deal demands cursory, customary or exhaustive diligence. If risk is low or if there is clear protection that can be provided in the Purchase Agreement, diligence can be more cursory. For example, my own diligence is more cursory for a new car backed by dealer/manufacturer guarantees, but I would use higher diligence efforts for a used car. And personally, my diligence will reach an exhaustive level if I ever buy that private island. For tools to decide how much diligence and on what priorities, see the Corollaries below.

- Fast? Is the integrated SME team working coherently and cohesively? Are you clearly communicating in an engaged way with your stakeholders? Or did you get caught scrambling after an unplanned or delinquent issue? Ideally, follow a structured playbook. And to mitigate any schedule risks, use a Front-End Loading process to better identify the scope; record the results in a Risk Matrix/Probability Matrix tool; and network iteratively with stakeholders. I usually take three formal passes at stakeholder concurrence as the diligence develops. But having said that, more experienced teams may compress the schedule with some calculated-risk shortcuts. For example, in order to accelerate time-to-closing, one deal team launched the DMO jointly with the Buyer while the negotiations were still moving. But that should be regarded as expert territory.

- Cheap? Diligence cost is really an outcome of the choices made around Good and Fast. As such, my playbook does not budget diligence cost. Instead, we deploy an experienced team and utilize a Risk Matrix approach to identify the subset that really has to be done well on the Good spectrum. Everything else is nice-to-have and can be traded if necessary for speed.

About Bruce Fleming:

About Bruce Fleming:

In addition to serving on the Board of M&A Standards, Bruce directs internal and external growth initiatives including alliances, acquisitions and targeted divestitures for Calumet. He has held senior business development and planning roles with Amoco Oil, Orient Refining, and Tesoro Corporation where he most recently directed acquisition of BP’s Carson, CA refinery including FTC approval, which Barron’s noted as “Acquisition of the Year.” Bruce is a featured presenter at M&A Leadership Council's The Art of M&A Due Diligence this November .